6 Tips For Using BNPL (Buy Now Pay Later)

Buy Now Pay Later (BNPL) is a payment method that allows customers to make purchases and pay for them later, usually in installments. This payment method has gained popularity recently as it provides a convenient and flexible payment option. However, it is crucial to use BNPL responsibly to avoid getting into debt and hurting your credit score. Here are tips on how to use BNPL properly.

Understand the Terms and Conditions

Before using BNPL, it is important to understand the terms and conditions of the service. You must read the fine print carefully and understand how the service works, including the interest rate, fees, and payment schedule. Some BNPL services offer interest-free periods or waive fees if you pay on time, while others may charge high-interest rates and late fees.

Medium/ Flickr | Almost half of Gen Z are expected to use BNPL by 2025

Stick to Your Budget

Using BNPL can be tempting, as it allows you to make purchases without having to pay for them immediately. However, it is important to stick to your budget and only use BNPL for purchases that you can afford to pay back. Make a list of the items you need and their prices, and only use BNPL for items that fit your budget.

Set a Repayment Schedule

One of the benefits of BNPL is that it allows you to pay for your purchases in installments. However, it is important to set a repayment schedule and stick to it. Make sure you know when your payments are due and set reminders to avoid missing a payment. Missing a payment can result in late fees and negatively impact your credit score.

Use BNPL for Essential Purchases Only

It’s easy to get tempted into using BNPL for non-essential purchases, such as clothes, gadgets, or luxury items. However, it’s important to reserve BNPL for essential purchases only, such as emergency expenses or big-ticket items that you need but can’t afford to pay in full upfront. Avoid using BNPL for impulse purchases or frivolous payments that can wait.

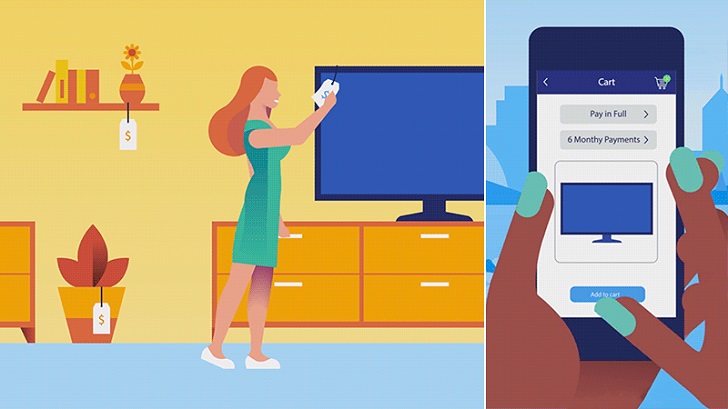

Visa/ Facebook | Buy now, pay later (BNPL) services have been on the rise for years, with companies such as Klarna, Zip, and Afterpay offering zero-interest

Keep Track of Your Payments

It is important to keep track of your BNPL payments to ensure that you pay on time and avoid late fees. Make a list of your payments and due dates, and check your account regularly to make sure your payments are being processed correctly. If you notice any errors or discrepancies, contact the BNPL provider immediately.

Pay off Your BNPL Balance as Soon as Possible

While BNPL can be a convenient way to make purchases, paying off your balance as soon as possible is important. The longer you wait to pay off your balance, the more interest and fees you accumulate. Make an effort to pay more than the minimum payment each month to reduce your balance and avoid paying unnecessary fees.

Avoid Making Multiple BNPL Purchases at the Same Time

If you have multiple BNPL purchases, it can be difficult to keep track of your payments and due dates. Avoid making various BNPL purchases simultaneously, especially if you have other bills and expenses to pay for. Ensure you have enough money to cover your BNPL payments before making any new purchases.

Pixabay/ Pexels | BNPL is a $248.1 billion global industry

Communicate with Your BNPL Provider

If you’re having trouble making your BNPL payments, don’t ignore the problem. Instead, communicate with your BNPL provider as soon as possible and explain your situation. Many providers offer hardship programs or payment plans to help you avoid late fees or defaults.

Being proactive and honest with your provider can help you avoid damaging your credit score and get back on track financially.